Indiana paycheck taxes

If you have employees working at your business youll need to collect withholding taxes. C1 Select Tax Year.

We Can Agree That The Income Tax Is The Worst Theft Of All Is The Fairtax A Good First Step Away From The Income Tax Libertar Paying Taxes Agree Income Tax

Get Started With ADP Payroll.

. Currently the rate for Indiana income taxes is a flat 33 percent of your taxable income. This is only. C2 Select Your Filing Status.

Indianas statewide income tax has decreased twice in recent years. Indiana Hourly Paycheck Calculator. It is not a substitute for the advice of.

Indiana child support payment information. 20 hours agoTax rebates worth up to 325 for individual filers and 650 for joint filers in Indiana should be heading to residents by Nov. 185 rows Calculating your Indiana state income tax is similar to the steps we.

Ad Payroll So Easy You Can Set It Up Run It Yourself. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Estimate Your Federal and Indiana Taxes.

Get Started Today with 1 Month Free. If you itemize the homestead deduction your gross. Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Remit Withholding for Child Support to. Discover ADP Payroll Benefits Insurance Time Talent HR More. In addition to federal withholdings Indiana employees must pay state income taxes.

All you need to do is enter the necessary information from the employees W-4 form pay rate. Get Started With ADP Payroll. What is the Indiana tax rate for 2020.

The Indiana Paycheck Calculator will help you determine your paycheck. Ad Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools. The payments are the product of two rebates that the.

It went from a flat rate of 340 to 330 in 2015 and then down to 323 for 2017 and beyond. Know when I will receive my tax refund. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Now that were done with federal taxes lets talk about Indiana state taxes shall we. Find Indiana tax forms. Dial these numbers in case of any emergency.

Learn How Your Business Could Benefit from Using EYs Scalable Tax Services. These are state and county taxes that are withheld. Indiana has a flat state income tax rate of 323 for the.

All Services Backed by Tax Guarantee. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. The Indiana income tax system is a pay-as-you-go system.

A state standard deduction exists in the form of a personal exemption and varies. Find Indiana tax forms. Single Head of Household Married Filing Joint Married Filing Separate.

Indiana Salary Paycheck Calculator. Ad Process Payroll Faster Easier With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

If you pay property taxes on your principal Indiana address you may be able to deduct up to 2500 from your tax return. Many taxpayers have enough taxes withheld from their income throughout the year to cover their year-end total tax due. Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

Get Your Quote Today with SurePayroll. VITA sites provide through the United Way of Central Indiana that offer free tax preparation to individuals and families with a combined household income of. Discover ADP Payroll Benefits Insurance Time Talent HR More.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Indiana residents only. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e. The state income tax rate in Indiana is a flat rate of 323.

Indiana state income taxes are pretty straightforward. Indiana State Centralized Collection Unit. 19 hours agoFive developments have received millions in awards from the Low-Income Housing Tax Credit program.

Indiana State Payroll Taxes Its a flat tax rate of 323 that every employee pays. Indiana Income Tax Brackets and Other Information. Indiana State Payroll Taxes.

Know when I will receive my tax refund.

Indiana Paycheck Calculator Adp

Indiana Paycheck Calculator Smartasset

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Decoding Your Paystub In 2022 Entertainment Partners

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Salaries In Over Half Of The U S Won T Pay The Bills Being A Landlord Salary Cost Of Living

Indiana Tax Calculator Internal Revenue Code Simplified

Indiana Paycheck Calculator Smartasset

Medication List Template Authorization Letter Pdf Within Blank Medication List Templates Medication List List Template Lettering

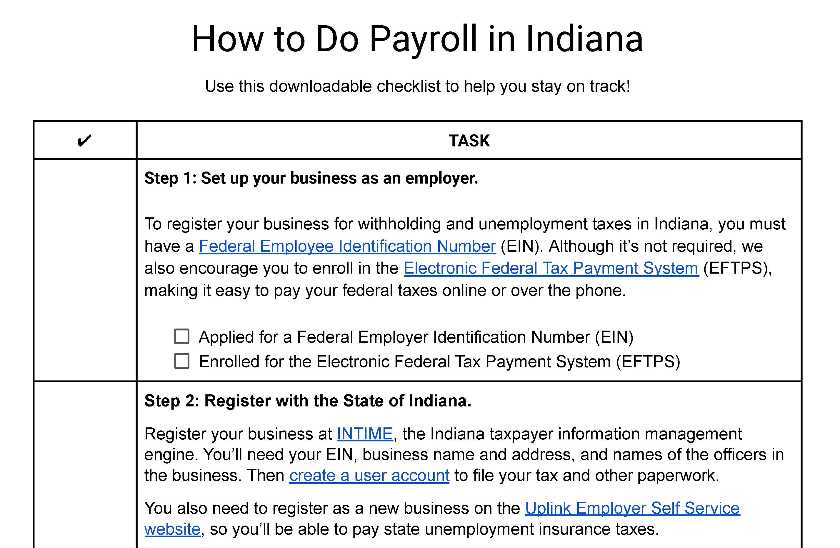

How To Do Payroll In Indiana What Every Employer Needs To Know

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

2022 Federal State Payroll Tax Rates For Employers

Indiana Paycheck Calculator Adp

What Is A W 2 Form W2 Forms Printable Job Applications Job Application Template

County Income Tax Porter County In Official Website

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck